san francisco gross receipts tax due date 2022

The Due Date For The 2021 Federal And California Income Tax Returns Is April 18 2022. Of Their Costs and Consequences.

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

The due date for filing the San Francisco 2021 Annual Business Tax SF ABT return which includes reporting and payment of 1 the Gross Receipts Tax GRT or Administrative Office Tax AOT 2 the Homelessness Tax HGRT or the Homelessness Administrative Office Tax HAOT and 3 the Commercial Rents Tax CRT is February 28 2022.

. In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date. Business license renewal due for the SF Office of the Treasurer and Tax Collector Department of Health Fire Department Police Department and Entertainment Commission. Feb 28Payroll Expense Tax and Gross Receipts Tax returns due Mar 31.

To provide COVID-19 pandemic relief the 2020 filing and final payment deadline for these taxes has been moved to April 30 2021 and the deadline to make payment of license. Estimated tax payments due dates include April 30th August 2nd and November 1st. The 2021 filing and final payment deadline for these taxes is February 28 2022.

The Ordinance replaces the existing payroll expense tax on the privilege of doing business in San Francisco with a tax that is based on gross receipts from business conducted within the city. To avoid late penaltiesfees the returns must be submitted and paid on or before Feb. San Francisco pushes back business registration due date.

Additionally businesses may be subject to up to four local San Francisco taxes. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. Tax filings are required to be completed online in most.

Property Tax Payment Due Dates For 2022Important Filing Deadlines Include The San Francisco Gross Receipts Filing Deadline Of February 28 And The April 1St Business Property Tax FilingLate Payments Will Incur A 10 Percent Penalty For Each Tax BillLien Date For All Taxable PropertyThis Is Right About Where Most Taxpayers Find Themselves. The deadline to file tax returns for all three taxes is February 28 2022. The filing obligation and tax rates for all three taxes vary based on the industry the business is involved with.

Due to COVID-19 the San Francisco Board of Supervisors has changed the due dates of certain business taxes and license fees. San Francisco Gross Receipts Tax Due Date 2022. To avoid late penaltiesfees the returns must be submitted and paid on or before February 28 2022.

Annual Business Tax Returns 2021 File by Feb. The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of taxable gross receipts. Heres what that means.

Due Dates for San Francisco Gross Receipts. Central to the reform was the eventual phase-out of the payroll tax and the phase-in of a new gross receipts tax GRT. 2 days agoExempt organizations.

San Franciscos New Local Tax Effective in 2022. The three taxes are the San Francisco Gross Receipts Tax the Homelessness Gross Receipts Tax and the Commercial Rents Tax. Additionally businesses may be subject to up to three city taxes.

The basic rationale underlying the phase-in was that the combination of revenues received under the GRT being phased-in and the. The San Francisco Gross Receipts Homelessness Gross Receipts Commercial Rents andor Payroll Expense tax. The Gross Receipts Tax and Business Registration Fees Ordinance or simply Ordinance was approved by San Francisco voters on November 6 2012.

Due date to file Form 571-L Business Personal Property Statement. Important filing deadlines include the San Francisco Gross Receipts filing deadline of February 28 and the April 1st business property tax filing. Effective january 1 2022 businesses subject to the san francisco administrative office tax aot must pay an additional annual overpaid executive tax oet of 04 to 24 on their payroll expense in san francisco when their highest paid managerial executive earns more than 100 times the median compensation.

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. The changes are reflected in the 2021 Annual Business Tax filings due February 28 2022. File Annual Business Tax Returns 2021.

Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing relief to certain industries and small businesses. Friday February 18 2022 Edit. Small exempt organizations with gross receipts normally of 50000 or less.

Published on 29 01072022 094949 am by underwearlovelysheetworkbaseco. The Gross Receipts Tax is filed as part of the Annual Business Tax Return. Apr 10 Deadline to pay the 2nd installment of property tax bill to the Tax Collectors Office.

C would raise SFs gross receipts tax. San Franciscos switch to gross receipts tax will be costly - The San. Because calculating your local income tax is relatively simple compared to your other tax returns many tax preparers will file your san francisco income tax return for free.

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. San Francisco Gross Receipts Tax Anatomy Of San Francisco Now Fewer People Jobs Tourists Businesses But More Spending By The Hangers On But That Was Inflation Wolf Street. The due dates for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement are the last days in April July and October respectively.

The current due date for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement is February 28. Interest and penalty if any will be levied by the city of San Francisco if the statement and payment arent submitted by midnight on the due date. Filing a 2021 e-Postcard Form 990-N if not filing Form 990 or Form 990-EZ.

The mission of our office is to work together to build a better San Francisco through superior customer service fair property taxation and the preservation of public. The deadline for paying license fees for the 2022-2023 period is March 31 2022. Beginning in 2014 the City of San Francisco implemented reforms to its then-current payroll tax regime.

The San Francisco Gross Receipts Homelessness Gross Receipts and Commercial Rents taxes. 150 The city of San Francisco levies a 150 gross receipts tax on the payroll expenses of large businesses. This tax adds to san franciscos broader gross receipts tax which applies rates ranging from 016 percent to 065 percent.

San Francisco Gross Receipts Tax Due Date 2022. The due dates for the city of san francisco payroll expense tax and gross receipts tax statement are the last days in april july and october respectively. Filing a 2021 calendar-year information return Form 990 Form 990-EZ or Form 990-PF or filing for an automatic six-month extension Form 8868 and paying any tax due.

Where To Buy Quant In 2022 With Lowest Fees And Safest Exchanges

Splunk Inc Announces Fiscal First Quarter 2022 Financial Results

Splunk Inc Announces Fiscal First Quarter 2022 Financial Results

Splunk Inc Announces Fiscal First Quarter 2022 Financial Results

Do You Have To Report A Ppp Loan On Your Taxes

Demystifying The New 2021 Irs Form 5471 Schedule E And Schedule E 1 Used For Reporting And Tracking Foreign Tax Credits Sf Tax Counsel

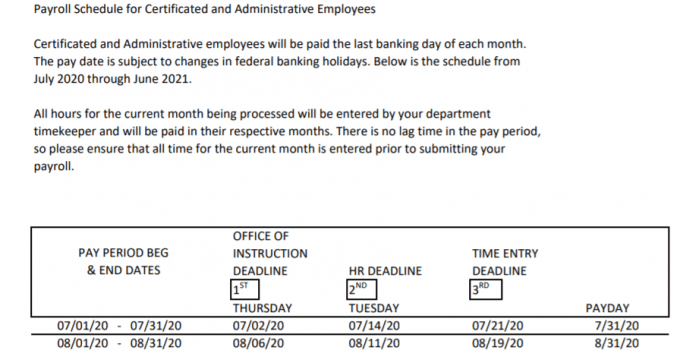

California Payroll Payroll Calendar

Splunk Inc Announces Fiscal First Quarter 2022 Financial Results

Important 2022 Tax Deadlines For Startups

3 12 220 Error Resolution System For Excise Tax Returns Internal Revenue Service

Recent Developments In Erisa 2022 Business Law Today From Aba

Multnomah County Preschool Tax Q A Kbf Cpas

Where To Buy Quant In 2022 With Lowest Fees And Safest Exchanges

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector